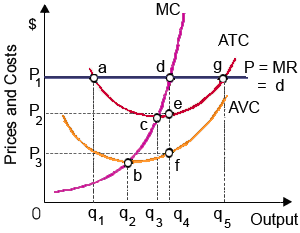

This illustrated graph is most consistent along with the environment confronted through a: (w) purely competitive firm which makes economic profit within the short run. (b) monopolistically-competitive firm into long run equilibrium. (c) firm along with oligopoly power which pursues a kinked-demand curve strategy. (d) pure monopoly which is capable to price discriminate.

Please choose the right answer from above...I want your suggestion for the same.