Suppose XYZ Airlines Ltd, better known as Superair, is XYZ’s third largest airline. Its passenger service and freighter network covers destinations across the Asia Pacific area. Since of the rising price of crude oil, Superair suffered a huge loss in the past fiscal year, so its financial manager is considering using derivatives to hedge the crude oil price.

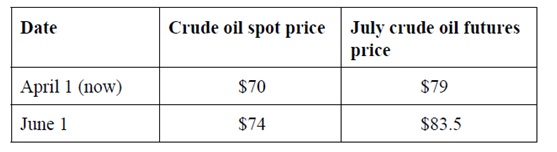

a) Assume Superair has to purchase 5 million US barrels of crude oil on June 1. Using the information listed in the table shown below, develop a hedging strategy for Superair to hedge the crude oil price and explain the effective cost/price paid by Superair for the crude oil per barrel after incorporating the gain and loss in the futures positions. Define clearly the buy or sell futures position of Superair and the number of contracts required. Crude oil futures trade in units of 1,000 US barrels.

b) Compute the bases on April 1 and June 1 and explain whether the hedge by Superair is a perfect hedge using the concept of basis risk.