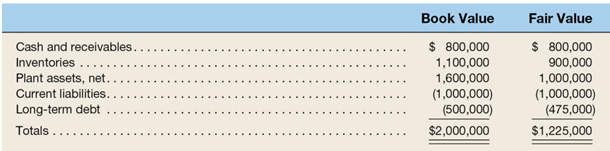

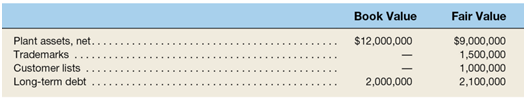

1. Eliminating Entries, Acquisition Expenses Pinnacle Corporation acquired all of Stengl Corporation's common stock in an exchange of common shares with a current market value of $10,000,000. Related accountants' and attorneys' fees were $300,000. The total book value of Stengl's stockholders' equity consists of capital stock of $200,000 and retained earnings of $1,800,000. Book values and fair values of Stengl's assets and liabilities are given below:

In addition, Stengl has previously unrecorded identifiable intangible assets with a fair value of $1,200,000 that meet FASB ASC Topic 805 criteria for recognition.

Required

Prepare the working paper eliminating entries to consolidate the balance sheets of Pinnacle Corporation and Stengl Corporation at the date of acquisition.

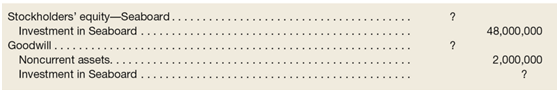

2.E3.6 Interpreting Eliminating Entries The following two consolidation eliminating entries were made immediately following Plains' acquisition of a 100 percent ownership interest in Seaboard for $88,000,000 cash:

Required

Compute the following amounts:

a. Book value of Seaboard at the date of acquisition.

b. Excess paid over the book value of net assets acquired.

c. Goodwill.

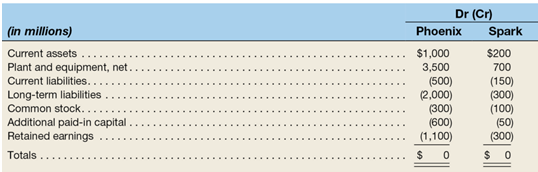

3. Acquisition Entry and Consolidation Working Paper On January 31, 2014, Phoenix, Inc. acquired all of the outstanding common stock of Spark Corporation for $400 million cash plus 25 million shares of Phoenix' $10 par value common stock having a market value of $90 per share. Registration fees were $5 million and merger-related consultant and legal fees were $8 million, paid in cash. Immediately prior to the acquisition, the trial balances of the two companies were

A review of the fair values of Spark's assets indicates that current assets are overvalued by $10 million, plant and equipment is undervalued by $200 million, and previously unreported brand names and trademarks have a fair value of $300 million.

Required

a. Prepare the entry Phoenix makes to record the acquisition of Spark.

b. Prepare a working paper to consolidate the balance sheets of Phoenix and Spark at January 31, 2014.

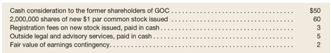

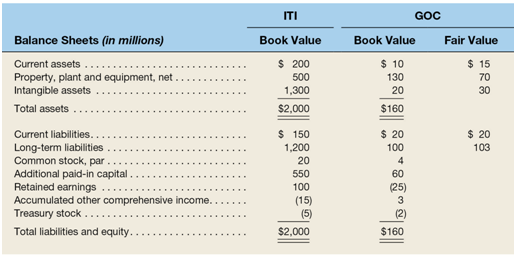

4. Consolidated Balance Sheet Working Paper, Identifiable Intangibles, Goodwill International Technology Inc. (ITI) acquires all of the voting stock of Global Outsourcing Corporation (GOC) on June 30, 2010. Amounts paid are as follows (in millions):

The earnings contingency provides for a potential payout to the former shareholders of GOC at the end of the third year following acquisition. The balance sheets of both companies immediately prior to the acquisition are as follows. Fair values of GOC's assets and liabilities at the date of acquisition are also provided.

The intangible assets reported above consist of patents and trademarks. GOC also has the following previously unreported intangible assets that meet FASB ASC Topic 805 requirements for asset recognition:

Required

a. Prepare the journal entry or entries ITI makes to record the acquisition on its own books.

b. Prepare a working paper to consolidate the balance sheets of ITI and GOC at June 30, 2010.

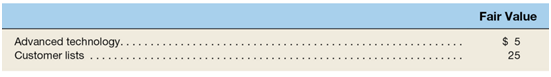

5.5 Consolidating Eliminating Entries, Date of Acquisition: U.S. GAAP and IFRS Plummer Corporation acquired 90 percent of Softek Technologies' voting stock on June 15, 2014, by issuing 2,000,000 shares of $2 par common stock with a fair value of $25,000,000. In addition, Plummer paid $500,000 in cash to the consultants and accountants who advised in the acquisition. Softek's stockholders' equity at the date of acquisition is as follows:

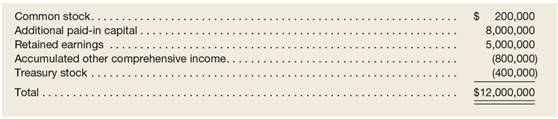

Softek's assets and liabilities were carried at fair value except as noted below:

The fair value of the noncontrolling interest is estimated to be $2,500,000 at the date of acquisition.

Required

a. Prepare the acquisition entry on Plummer's books and the working paper consolidation eliminating entries on June 15, 2014, following U.S. GAAP.